- 20 Marks

Question

Nationwide Plc is a conglomerate with subsidiaries in two geographical locations. Each of the subsidiaries has stamped its foot in relevant subsectors and contributes to the group’s gross earnings. Segment information is prepared on the basis of geographical areas as well as business lines.

Segment Information By Geographical Areas as at December 31, 2012:

| Subsidiary I | Nigeria (N’m) | Europe (N’m) | Total (N’m) |

|---|---|---|---|

| Derived From External Customers | 110,419 | 2,375 | 112,794 |

| Total Revenue | 110,419 | 2,375 | 112,794 |

| Interest And Similar Expenses | (25,398) | (271) | (25,669) |

| Operating Income | 85,021 | 2,104 | 87,125 |

| Share Of Profit Of Equity Accounted Investee | 1,850 | 0 | 1,850 |

| Operating Expenses | (75,507) | (1,530) | (77,037) |

| Net Impairment Loss On Financial Assets | (2,772) | (106) | (2,878) |

| Profit Before Taxation | 8,592 | 468 | 9,060 |

| Income Tax Credit/(Expense) | (1,572) | (113) | (1,685) |

| Profit After Taxation | 7,020 | 355 | 7,375 |

Assets And Liabilities:

| Subsidiary I | Nigeria (N’m) | Europe (N’m) | Total (N’m) |

|---|---|---|---|

| Total Assets | 954,165 | 78,882 | 1,033,047 |

| Total Liabilities | (781,019) | (57,630) | (838,649) |

| Net Assets | 173,146 | 21,252 | 194,398 |

| Subsidiary II | Nigeria (N’m) | Europe (N’m) | Total (N’m) |

|---|---|---|---|

| Derived From External Customers | 82,566 | 2,535 | 85,101 |

| Total Revenue | 82,566 | 2,535 | 85,101 |

| Interest And Similar Expenses | (34,049) | (263) | (34,312) |

| Operating Income | 48,517 | 2,272 | 50,789 |

| Share Of Profit Of Equity Accounted Investee | 952 | 0 | 952 |

| Operating Expenses | (88,429) | (1,468) | (89,897) |

| Net Impairment Loss On Financial Assets | (69,525) | (3) | (69,528) |

| Profit/(Loss) Before Taxation | (108,485) | 801 | (107,684) |

| Income Tax Credit/(Expense) | 25,346 | (213) | 25,133 |

| Profit/(Loss) After Taxation | (83,139) | 588 | (82,551) |

Assets And Liabilities:

| Subsidiary II | Nigeria (N’m) | Europe (N’m) | Total (N’m) |

|---|---|---|---|

| Total Assets | 899,434 | 155,300 | 1,054,734 |

| Total Liabilities | (711,678) | (143,684) | (855,362) |

| Net Assets | 187,756 | 11,616 | 199,372 |

Required:

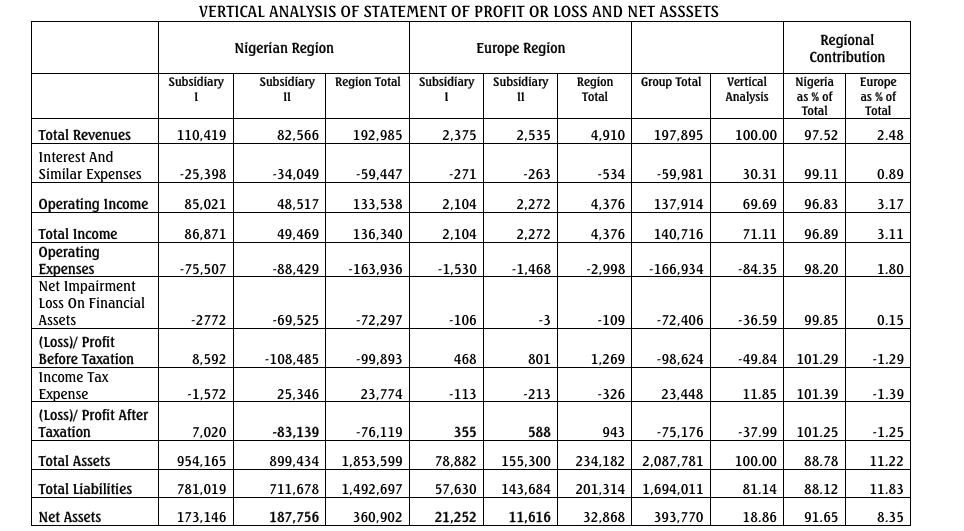

You are required to appraise the contributions of each of the geographical locations to the group’s performance through a vertical analysis from the segment information.

Answer

Appraisal:

- The Nigerian region dominates group performance, contributing significantly to revenue, assets, and liabilities.

- Europe provides minimal contributions, indicating high concentration risk.

- Net impairment losses are predominantly from Nigeria, highlighting asset risk within this region.

- Topic: Segment Reporting (IFRS 8)

- Series: NOV 2016

- Uploader: Dotse