- 14 Marks

Question

The Chief Executive Officer (CEO) of Agege Plc. has forwarded the draft financial statements of Somolu Limited through an e-mail to you as the company’s financial consultants.

In the e-mail, the CEO informed you that Agege Plc. is planning to acquire Somolu Limited. Somolu Limited is a private limited company that has recently applied for additional funds which was rejected from its current bankers on the basis that the company has insufficient assets to offer as security.

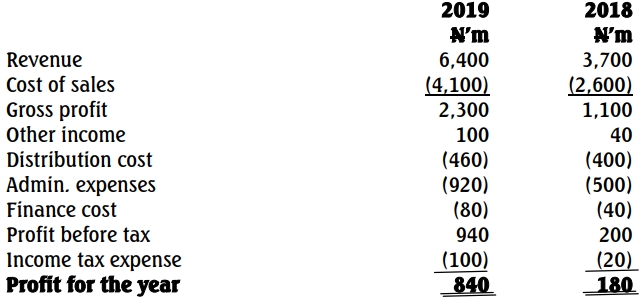

The draft financial statements of Somolu Limited as at December 31, 2019, are as follows:

Somolu Limited

Statement of profit or loss and other comprehensive income for the year ended December 31, 2019

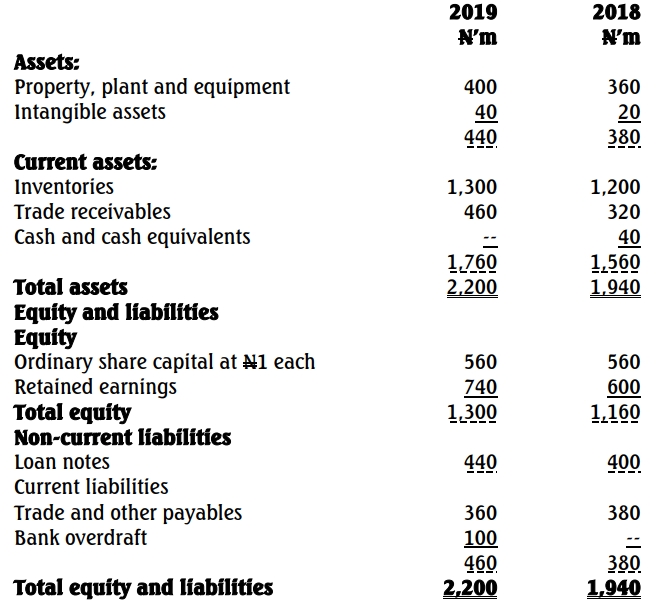

Somolu Limited

Statement of financial position as at December 31, 2019

Required:

a. Carry out a critical analysis of the financial performance and position of Somolu

Limited together with recommendations as to whether Agege Limited should

consider the investment in Somolu Limited. (14 Marks)

Answer

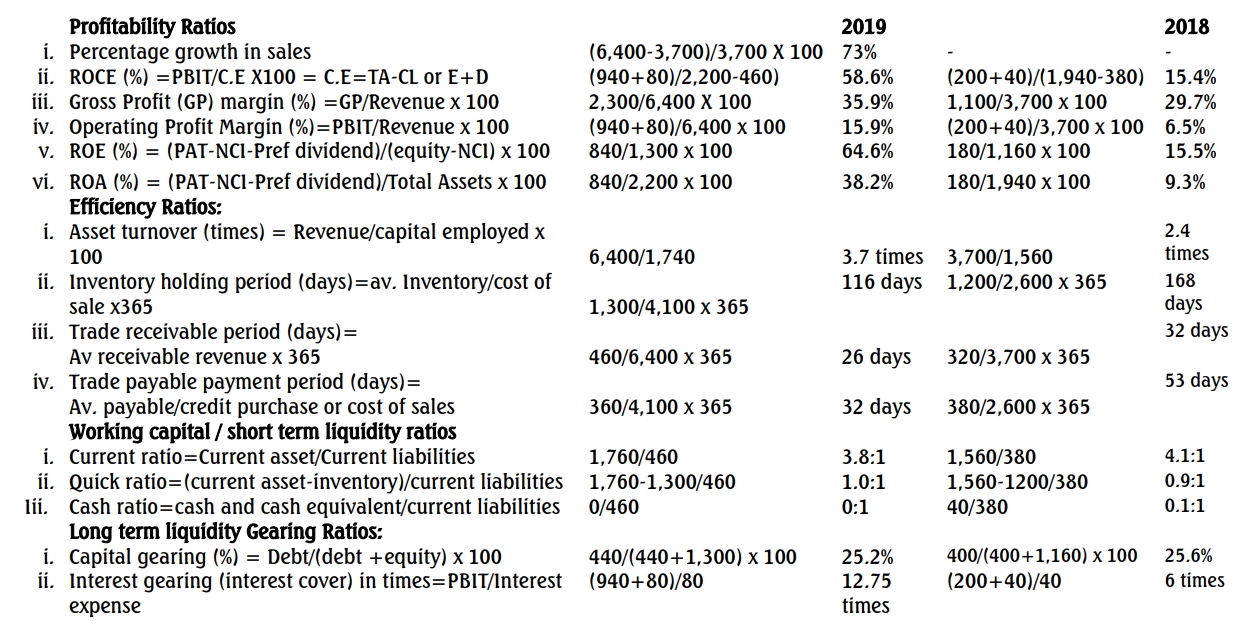

a. Analysis of Somolu Limited’s Financial Performance and Position

Introduction:

A potential acquirer (Agege Limited) needs insight into Somolu Limited’s profitability, efficiency, and financial stability to make informed investment decisions. The analysis is based on key financial ratios derived from the financial statements provided.

1. Percentage Growth in Sales/Revenue:

- Revenue increased by 73% from N3,700 million in 2018 to N6,400 million in 2019.

- Indicates potential adoption of effective marketing or operational strategies.

2. Profitability:

- Gross Profit Margin: Improved from 29.7% (2018) to 36% (2019), reflecting better cost management.

- Operating Profit Margin: Increased from 5.5% to 15.9%, showing enhanced operational efficiency.

- Return on Capital Employed (ROCE): Improved significantly from 15.4% to 58.6%, driven by higher profit margins and efficient asset utilization.

3. Efficiency Ratios:

- Asset Turnover: Increased from 2.4 times (2018) to 3.7 times (2019), indicating better use of assets to generate revenue.

- Inventory Holding Period: Declined from 168 days to 116 days, reflecting quicker inventory turnover to meet demand.

- Trade Receivables Period: Improved from 32 days to 26 days, indicating faster cash collection.

- Trade Payables Period: Shortened from 53 days to 32 days, suggesting quicker supplier payments.

4. Liquidity:

- Current Ratio: Declined from 4.1:1 (2018) to 3.8:1 (2019), still above the acceptable threshold, reflecting good short-term liquidity.

- Quick Ratio: Declined slightly but remains stable at 1.0:1 (2019), showing sufficient liquid assets.

- Cash Ratio: Declined to 0:1 due to a lack of cash in 2019.

5. Gearing and Financial Risk:

- Gearing Ratio: Improved marginally from 25.6% (2018) to 25.2% (2019), reflecting low reliance on debt.

- Interest Cover: Increased from 6 times to 13 times, indicating a strong ability to cover interest expenses.

Conclusion:

Based on the analysis:

- Somolu Limited demonstrates improved growth, profitability, and operational efficiency.

- The company maintains a good liquidity position but should address reliance on a bank overdraft for long-term stability.

Recommendation:

- Agege Limited should consider investing in Somolu Limited given its growth trajectory, profitability, and efficient use of resources.

- Somolu should optimize working capital management to reduce dependence on overdraft facilities.

- Tags: Financial Analysis, IFRS, Ratios, Reporting Standards

- Level: Level 3

- Uploader: Kofi