- 20 Marks

Question

You are a Financial Analyst at Tayo Research Group (TRG). You begin valuing Aba Hotels Plc (AHP), a thinly and infrequently traded stock currently selling at 217 kobo, cum 2021 dividend.

For estimating AHP’s required return on equity, TRG uses the capital asset pricing model (CAPM) approach, but you think its equity beta of 1.20 is not reliable because of the stock’s extremely thin trading volume. You have therefore obtained the beta and other pertinent data for Eko Hotel Plc (EHP) – (See Table 1), a midsized company in the same industry with high liquidity trading on the Nigerian Stock Exchange.

Table 1: Valuation Data for EHP

| Parameter | Value |

|---|---|

| Asset beta | 0.763 |

| Debt beta | 0.150 |

| Debt ratio (D/D+E) | 0.60 |

| Effective tax rate (%) | 30% |

Summarised financial data for AHP is shown below:

Statement of Profit or Loss Account

| Year | 2019 | 2020 | 2021* |

|---|---|---|---|

| Sales (₦’000) | 305,500 | 357,600 | 409,200 |

| Taxable income (₦’000) | 40,500 | 49,000 | 56,700 |

| Taxation (₦’000) | (14,175) | (17,150) | (19,845) |

| Post-tax income (₦’000) | 26,325 | 31,850 | 36,855 |

| Dividend (₦’000) | (9,340) | (10,228) | (11,200) |

| Retained earnings (₦’000) | 16,985 | 21,622 | 25,655 |

Statement of Financial Position

| Year | 2021* |

|---|---|

| Non-current assets (₦’000) | 216,800 |

| Current assets (₦’000) | 158,000 |

| Current liabilities (₦’000) | (104,800) |

| Net assets (₦’000) | 270,000 |

| Ordinary shares (₦0.50 par value) | 80,000 |

| Reserves (₦’000) | 130,000 |

| 15% Bond 2026 (₦100 par value) | 60,000 |

(*2021 figures are unaudited)

Other Relevant Information:

- It has been estimated that the debt/equity ratio of AHP is 0.16 and the beta of its debt is 0.2.

- The risk-free rate is 12% and the market risk premium is 5%.

- AHP has an effective tax rate of 35%.

- As a result of recent capital investment, stock market analysts expect post-tax earnings and dividends to increase by 25% for two years and then revert to the company’s existing growth rates.

Required:

a. Stock market analysts sometimes use fundamental analysis and sometimes technical analysis to forecast future share prices.

What are fundamental analysis and technical analysis? (4 Marks)

b. Using the dividend valuation model, estimate what a fundamental analyst might consider to be the intrinsic (or realistic) value of the company’s shares.

Comment upon the significance of your estimate for the fundamental analyst. (12 Marks)

c. Explain whether your answer to (b) above is consistent with the semi-strong and strong forms of the efficient markets hypothesis (EMH), and comment upon whether financial analysts serve any useful purpose in an efficient market. (4 Marks)

Answer

a)

Fundamental Analysis:

Fundamental analysis involves the study of a company’s earnings, dividends, and other financial information to predict future share prices. Fundamental analysts investigate companies in depth and use various valuation models to estimate the “intrinsic, realistic, or underlying” value of a share, which they believe might differ from the current market price. If the intrinsic value is estimated to be above the current share price, the advice would be to buy the share in question.

Techniques Used in Fundamental Analysis:

- Dividend growth models

- Earnings yield models

- Regression models

Technical Analysis (Chartism):

The most important form of technical analysis is Chartism. Chartism involves the study of historic share price and volume information to see if any patterns or relationships exist.

Beliefs and Methods of Chartists:

- Chartists believe that historic share price behavior, as revealed by patterns, will repeat itself.

- They analyze charts of current share price movements to identify whether established historic patterns are currently occurring.

- If such patterns are identified, chartists believe these historic patterns will reveal future share price movements.

Key Characteristics of Technical Analysis:

- Does not require knowledge of company earnings or other economic data.

- Often criticized for having no underlying economic logic.

b) Using the Dividend Valuation Model (DVM):

To estimate the intrinsic value of Aba Hotels Plc (AHP), the dividend valuation model is applied.

βE = βA + (βA − βD) (VD/VE) (1 − t)

where

βA = asset beta of the proxy = 0.763

βD = beta of debt of AHP = 0.2

VD/VE = debt/equity ratio of AHP = 0.16

t = effective tax rate of AHP = 0.35

βE = 0.763 + (0.763 – 0.2)(0.16)(1 – 0.35) = 0.82

• KE = 12 + 0.82(5) = 16%

Current growth rate

From the dividend history:

g = (11,200/9,340)1/2 – 1 = 9.5%

Dividend per share

Number of shares = 80m/0.5 = 160 million

Current dividend per share = ₦11,200/160,000 = ₦0.07

This means that the current ex-dividend value per share = 217 – 7 = 210 kobo

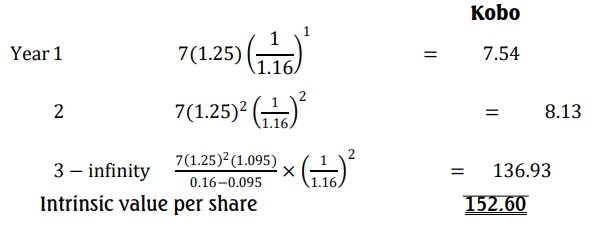

Calculation of intrinsic value per share

This is given as the present value of future dividends:

The significance to the fundamental analyst would be that AHP‟s shares, currently trading at 210 kobo (ex-div), are overpriced and are likely to fall in value. The analyst would recommend investors owning AHP‟s share to sell their shares.

c) Efficient Market Hypothesis (EMH):

Consistency with Semi-Strong and Strong Forms of EMH:

- Semi-Strong Form:

- Suggests that all publicly available information, including past dividends and growth rates, is already reflected in the share price.

- If the market operates in the semi-strong form, the intrinsic value computed using fundamental analysis would already be reflected in the current share price.

- Strong Form:

- Implies that all information, both public and private, is incorporated into the share price.

- Under this form, even private calculations of intrinsic value offer no advantage, as prices reflect all possible data.

Usefulness of Financial Analysts in an Efficient Market:

While the EMH diminishes the value of forecasting share prices (especially in strong-form markets), financial analysts play a critical role in:

- Interpreting and disseminating information to investors.

- Enhancing market efficiency by ensuring quick and accurate information flow.

- Providing insights into corporate performance, aiding in governance, and improving investor confidence.

- Tags: CAPM, Dividend valuation, Efficient Markets, Fundamental Analysis, Technical Analysis

- Level: Level 3

- Uploader: Kofi