- 14 Marks

Question

Octopus Petroleum PLC is a multinational oil and gas group operating in the Niger Delta areas of Nigeria. The company has been highly profitable over the years. The group explores and extracts natural resources, holds reserves, and has recently become involved in the downstream sector by opening various commercial retail outlets for the sale of petrol to motorists.

In June 2020, the company was involved in an ecological disaster in the Ogoni area of Niger Delta as a result of massive oil spillage due to some technical faults, thereby resulting in spilling oil into the surrounding ocean and damaging wildlife and local communities.

Investors are concerned about the future prospects of Octopus Petroleum PLC and whether it represents a safe investment since the company normally operates in the lucrative oil and gas sector.

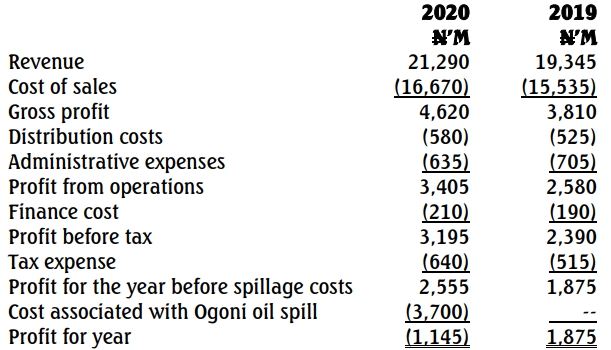

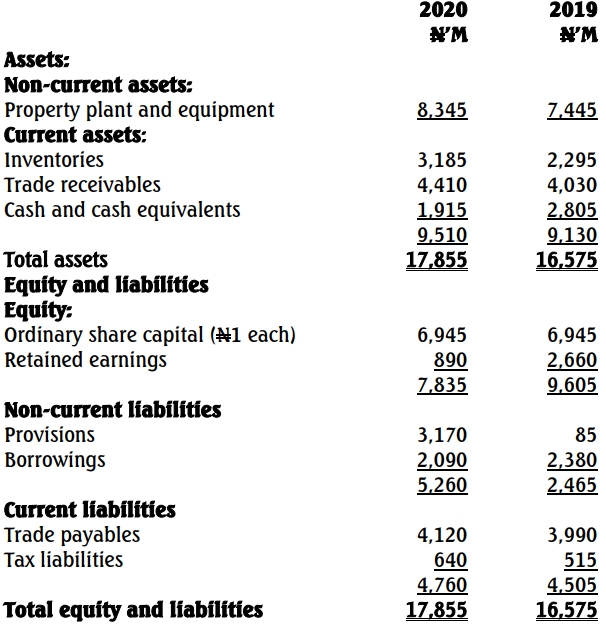

Octopus Petroleum Group annual report for the year 2020 and its comparative figures are shown below:

Octopus Petroleum Group Consolidated Statement of Profit or Loss for the Year Ended December 31

Octopus Petroleum Group Consolidated Statement of Financial Position as at December 31

Additional Information:

- The N3,700 million provision for the Ogoni oil spill is an estimated cost net of relevant tax.

- Calculating the financial cost of the oil spill in Ogoni land has been slightly problematic. However, N530 million had been expended by year-end, while the future costs of clean-up and compensation are undetermined.

- One uncertain cost is fines payable to the Federal Government of Nigeria. Past fines have exceeded N2,500 million.

- Octopus Petroleum Group vertically integrated in 2020 by acquiring and rebranding petrol stations.

- Oil reserves were at record-high levels in 2020.

- Oil prices increased by approximately 5% during 2020.

- The company values inventory on a last-in-first-out (LIFO) basis, which contravenes IAS 2.

- Dividend payments remained at N625 million for both 2020 and 2019.

- Investors typically evaluate companies using these ratios:

- Profitability Ratios:

- Return on Capital Employed (ROCE)

- Return on Equity (ROE)

- Gross Profit Percentage

- Operating Profit Percentage

- Liquidity Ratios:

- Current Ratio

- Acid Test Ratio

- Resource Utilization and Financial Position Ratios:

- Inventory Turnover

- Asset Turnover

- Interest Cover

- Gearing Ratio

- Profitability Ratios:

Required:

(a) Analyze the performance of Octopus Petroleum Group over the two-year period. Your analysis should also consider the group’s ability to finance the cost of the oil spill in Ogoni land in the coming years. (14 Marks)

Answer

Octopus petroleum group

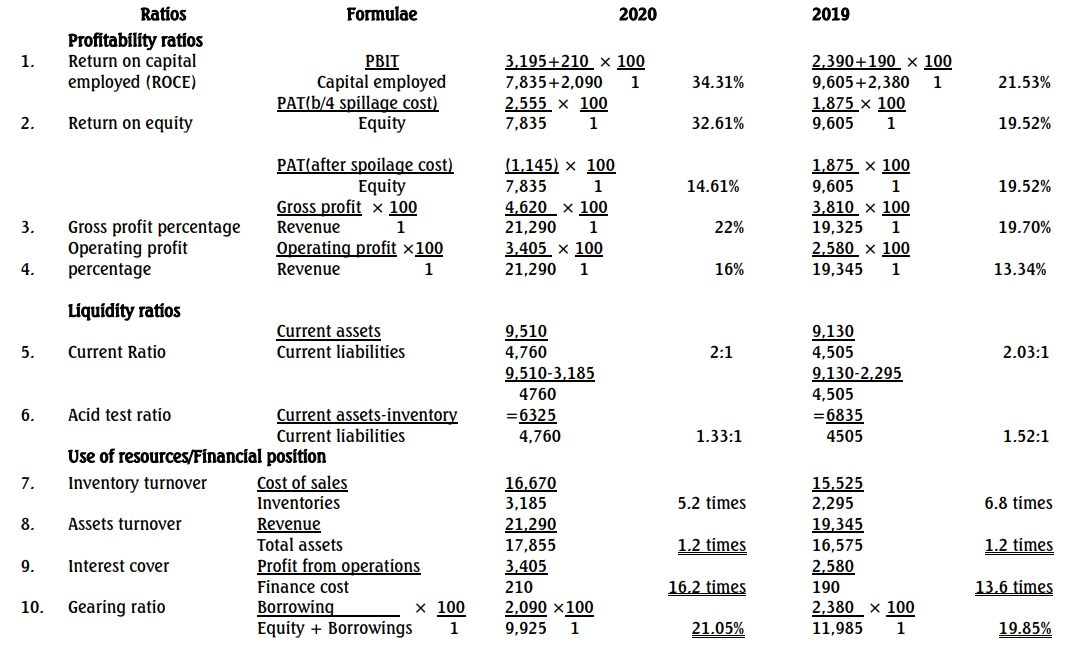

Calculation of the relevant ratios

Analysis and Interpretation of Ratios

Profitability

- Octopus Petroleum Group’s underlying profit performance in 2020 is strong, reflected by an increase in profit by ₦680 million from 2019.

- This strong profit performance is also reflected in the Return on Capital Employed (ROCE), which increased from 21.52% in 2019 to 34.3% in 2020.

- The decline in Return on Equity (ROE) from 19.7% in 2019 to a negative (14.61%) in 2020 was due to the huge provision for costs associated with the oil spillage of ₦3,700 million in 2020.

- Vertical integration during the year, through the establishment of petrol stations, contributed to over 10% growth in revenue, from ₦19,345 million to ₦21,290 million.

- Overheads were well-managed, as shown by an increase in the Operating Profit Percentage from 19.7% to 21.7%.

Liquidity

- The liquidity position of the company appeared stable, with a Current Ratio of 2:1 for both 2019 and 2020.

- However, there has been a negative shift in liquidity when considering the Acid-Test Ratio, mainly due to:

- A decline in cash position caused by payments for oil spill costs.

- An increase in inventory levels.

- The company’s cash position may decline further due to potential fines and penalties related to the oil spill in the future.

Use of Resources or Financial Position

- Inventory Turnover has reduced significantly, contributing to the stability of the Current Ratio.

- High levels of oil reserves and higher oil prices, coupled with the use of the LIFO valuation system, have resulted in much inventory.

- The additional reserves needed for petrol stations also contributed to the inventory increase.

- The group’s financial position remains fairly strong:

- Interest Cover has improved over the years.

- Gearing has increased slightly despite repayments of borrowings during the year.

- The substantial loss in 2020 has significantly reduced the Group’s equity.

Overall

- The profit performance of the company is good, with increasing margins, improved revenue, and adequate provisions for potential oil spill costs.

- The group has maintained its dividend payment level at ₦625 million for both 2019 and 2020, despite the oil spill costs.

- The oil spill disaster will impact the group’s financial performance and position in future years. However, the company’s core business remains strong, and its oil reserves have grown by year-end.

- Cash and cash equivalents have declined and are insufficient to cover known oil spill costs. However:

- The oil reserves could be quickly disposed of to absorb liquidity issues.

- The group’s low gearing level provides room for additional borrowings to meet future obligations.

- Tags: Environmental Issues, Gearing, IAS 2, IAS 37, Liquidity Ratios, Oil Spill Costs, Profitability Ratios

- Level: Level 3

- Uploader: Kofi