- 20 Marks

Question

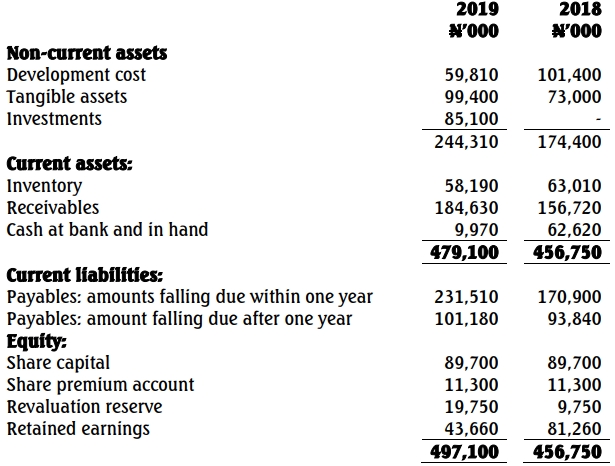

Your firm is the auditor of Sharp Electronics Co. Plc, a listed company, which assembles electronic home appliances for sale on retail and wholesale bases. The electronic appliances parts are purchased from within and outside the country. The extract from the statement of financial position of the company is as follows:

Sharp Electronics Co. Plc – Statement of Financial Position

You have been asked by the partner in charge of the audit to consider your firm’s audit responsibilities with respect to subsequent events, and the associated audit procedures for such matters.

Required:

a. Discuss the responsibilities of the auditors for detecting misstatements in the financial statements during the following periods:

i. From the end of the reporting period up to the date of the audit report. (8 Marks)

ii. After the date of the audit report and before financial statements are issued. (6 Marks)

iii. After the financial statements have been issued. (3 Marks)

b. State the details of the work you will carry out in period (a)(ii) above to identify significant subsequent events affecting the financial statements. (5 Marks)

Answer

a. Auditor’s Responsibilities for Detecting Misstatements:

- i. From the End of the Reporting Period up to the Date of the Audit Report:

- The auditor is responsible for actively seeking information on events that may impact the financial statements during this period. This includes reviewing management’s actions, examining interim financial statements, and assessing whether significant transactions or changes in business conditions have occurred.

- Procedures such as reviewing post-reporting transactions, investigating unusual entries, and inquiring about significant contingencies are vital.

- The auditor must obtain written representations from management confirming that all material subsequent events have been disclosed.

- ii. After the Date of the Audit Report and Before Financial Statements Are Issued:

- Although the auditor’s primary fieldwork is complete, they are required to respond if new information emerges that materially affects the financial statements. The auditor should re-assess the audit evidence, ensuring that any significant events that could influence the users’ decisions are disclosed or adjusted in the financial statements.

- Any necessary adjustments or disclosures should be included to reflect these events accurately.

- iii. After the Financial Statements Have Been Issued:

- The auditor is generally not responsible for actively seeking subsequent events. However, if the auditor becomes aware of a material misstatement, they must assess the significance and communicate with the entity’s management or those charged with governance.

- If management agrees to reissue corrected financial statements, the auditor should review these amendments and confirm the accuracy of restated information.

b. Audit Procedures for Period (a)(ii):

- Post-reporting Date Transactions: Review subsequent payments, receipts, and transactions after the reporting date to identify significant adjustments or unusual entries.

- Inquiry with Management and Legal Counsel: Make inquiries regarding any new legal actions, commitments, or events that could influence the entity’s financial condition.

- Board Minutes and Financial Updates: Examine minutes of board meetings and internal financial updates post-reporting to capture any material developments.

- External Information Review: Evaluate external reports, news, or industry developments that might indicate changes in business risks or financial exposures.

- Adjustments and Disclosure Recommendations: Document findings and advise on adjustments or disclosures as necessary to reflect material events adequately.

- Uploader: Kofi