- 30 Marks

Question

Carrol Nigeria Limited, a medium-sized company, commenced business in 2011. The company has three subsidiaries in the manufacturing of household utensils and baby products. Over the last three years, its fortunes have dwindled due to high costs of imported raw materials, overheads, low patronage from customers, and increasing demands from the host communities for social amenities.

Due to the challenging business environment, the board decided in 2016 to reduce workforce and permanently close one of its subsidiaries. This led to the appointment of a young accountant with limited taxation and fiscal policy knowledge as the Group Accountant after two Finance Department staff were affected.

In the past three years, the company faced challenges with tax authorities on tax compliance. The Group Managing Director was embarrassed when informed by the tax officer that essential records necessary for determining tax liabilities were not maintained. Gaps were also observed in the annual returns filed by the company, and the Revenue Service is conducting a back duty audit.

The Group Managing Director has sought assistance in addressing these challenges and provided documents for recomputation of the company’s income tax liabilities for the year ended December 31, 2020.

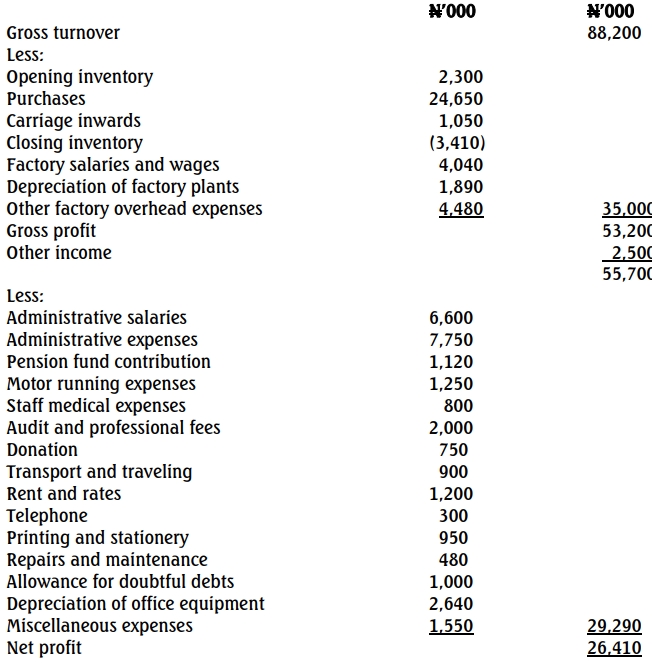

The statement of profit or loss for the year ended December 31, 2020, is as follows:

Additional Information:

- Other income included ₦320,000 realized from the disposal of an old plant.

- Administrative expenses included ₦250,000 paid to a legal practitioner for the defense and release of the company’s driver caught by traffic officers.

- 30% of motor running expenses was expended on the personal expenses of the Managing Director.

- 20% of the donation was paid to a State Government fund assisting insurgent victims.

- Repairs and maintenance included ₦215,000 for erecting a gate destroyed during a youth protest.

- Allowance for doubtful debts comprised ₦600,000 in general provision and ₦400,000 in specific provision.

- Miscellaneous expenses included ₦450,000 for hamper gifts to customers during Sallah and Christmas.

- A review revealed the gross turnover was understated by ₦750,000.

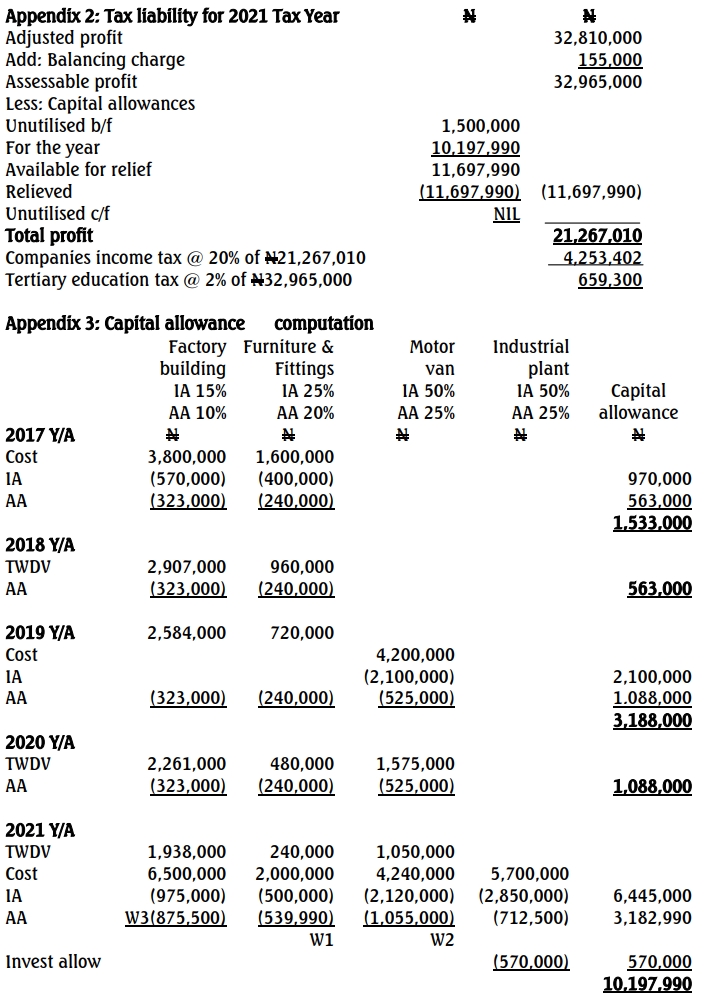

- The following is the schedule of qualifying capital expenditure on property, plant, and equipment:

Nature Date of Acquisition Amount (₦’000) Factory building September 8, 2016 3,800 Furniture & fittings October 12, 2016 1,600 Motor van June 19, 2018 4,200 Factory building March 8, 2020 6,500 Furniture & fittings April 15, 2020 2,000 Industrial plant July 1, 2020 5,700 Motor van December 20, 2020 4,240 - Unutilized capital allowances brought forward was ₦1,500,000, with a balancing charge of ₦155,000 on disposal of the old plant.

Required:

As the company’s tax consultant, prepare a report to the Group Managing Director covering the following:

a. Provisions of the Companies Income Tax Act CAP C21 LFN 2004 (as amended) and Finance Act 2020 regarding maintenance of books or records of accounts (4 Marks)

b. Back duty audit and its implications (4 Marks)

c. Computation of the company’s tax liabilities (with supporting schedules) for the relevant tax year (22 Marks)

Answer

To: Group Managing Director, Carrol Nigeria Limited

From: Tax Consultant

Subject: Maintenance of Books or Records of Accounts, Back Audit, and Computed Tax Liabilities

a. Provisions of Companies Income Tax Act (CITA) CAP C21 LFN 2004 (as amended) and Finance Act 2020 on Maintenance of Books or Records of Accounts

- Maintenance Requirements: All companies, regardless of their tax liability, are required to maintain detailed records or books in English, documenting transactions for accurate tax assessments.

- Format Consistency: For tax purposes, these records must align with any prescribed format by the Revenue Service.

- Language Translation: If records are kept in a language other than English, the company must provide a certified English translation upon the Revenue Service’s request.

- Penalties: Failure to provide required records incurs a penalty of ₦100,000 in the first month and ₦50,000 for each following month of non-compliance.

b. Back Duty Audit and its Implications

- Definition: A back duty audit is an extensive examination by tax authorities of prior years’ tax records to identify potential underreporting or non-compliance.

- Implications for Carrol Nigeria Ltd:

- Financial: Potential adjustments and increased liabilities for previously omitted income or incorrect deductions.

- Operational: May strain resources as employees assist auditors and retrieve historical records.

- Compliance: Reinforces the necessity of accurate, comprehensive record-keeping.

c.

Computation of the Company’s Tax Liability

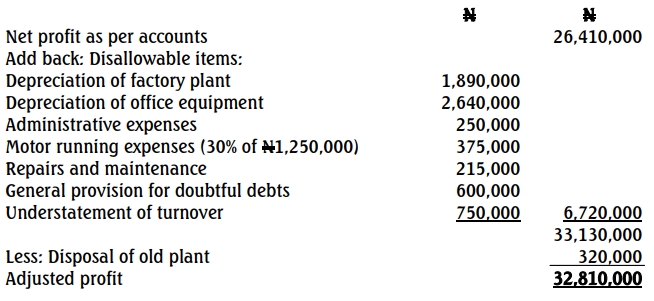

The attached Appendices 1, 2, and 3 present the calculations and details of the adjusted profit, tax liability, and capital allowances. Here is a summary of the results:

- Adjusted Profit: The company’s adjusted profit for the year ended December 31, 2020, was ₦32,810,000.

- Capital Allowance Relief: The company utilized capital allowances totaling ₦11,697,990, resulting in a total taxable profit of ₦21,267,010.

- Companies Income Tax:

- As per the Finance Act 2019, Carrol Nigeria Limited, being classified as a medium-sized company, is subject to a corporate tax rate of 20%.

- The computed income tax liability is ₦4,253,402.

- Tertiary Education Tax:

- Under the Tertiary Education Trust Fund (Establishment, etc.) Act 2011 (as amended), the company must pay 2% of its assessable profit as Tertiary Education Tax.

- This amounts to ₦659,300.

- Filing and Payment:

- To avoid penalties, the company is advised to submit its annual returns, including the audited financial statements and the tax computation schedules, to the Revenue Service within the prescribed statutory timeframe.

For further clarification, please feel free to reach out.

Yours faithfully,

Raheem Ojo

Principal Partner

For: Shinny Tax Consultants

Appendix 1: Computation of adjusted profit for the year ended December 31, 2020

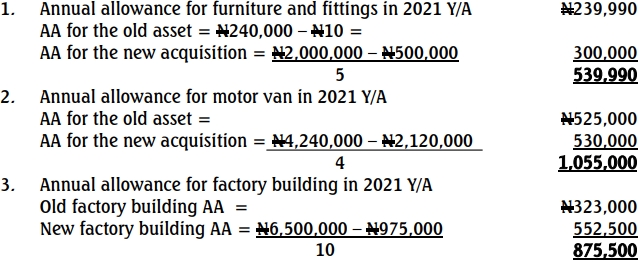

Workings

- Uploader: Kofi