- 15 Marks

Question

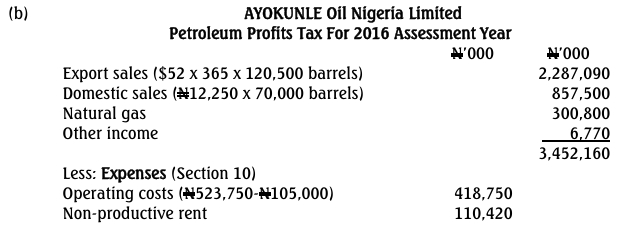

Ayokunle Oil Nigeria Limited engages in petroleum operations. The company was incorporated in 2005 but commenced business in January 2010. It operates in the continental shelf at a water depth of 155 metres. The company makes up its accounts to December 31 each year.

The company has presented the following statement of activities for the year ended December 31, 2016:

- Sales of crude oil:

- Exported at $52 per barrel: 120,500 barrels

- Domestic at N12,250 per barrel: 70,000 barrels

- Chargeable natural gas sold: N300,800,000

- Income from other sources: N6,770,000

Expenses incurred:

| Expense Type | Amount (₦) |

|---|---|

| Operating costs | 523,750 |

| Non-productive rent | 110,420 |

| Intangible drilling cost | 439,000 |

| Custom duty | 53,200 |

| Salaries and other personnel costs | 280,500 |

| Interest paid | 50,410 |

| Royalty on oil exported | 110,600 |

| Royalty on local sales | 41,200 |

| Stamp duty | 1,050 |

| Donations | 22,000 |

| Transportation | 72,070 |

| Administration and general expenses | 340,200 |

| Bad debts | 66,000 |

| Pension contribution | 21,000 |

| Miscellaneous expenses | 32,170 |

Additional Information:

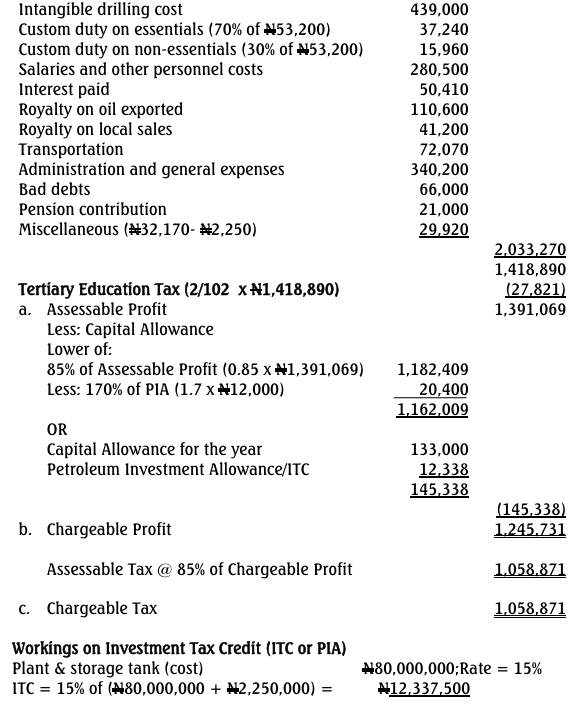

- Capital allowances were agreed at ₦133,000,000.

- Plant and storage tank acquired and used during the year amounted to ₦80,000,000.

- Depreciation of ₦105,000,000 was included in operating costs.

- Custom duty on plant and storage tank, ₦2,250,000, was included in miscellaneous expenses.

- 70% of custom duty was on essential items.

- The average exchange rate during the period was ₦365 to $1 (USA).

Required:

Determine for the relevant assessment year the following:

a. Assessable Profit (7 Marks)

b. Chargeable Profit (3 Marks)

c. Chargeable Tax (1 Mark)

(Total 15 Marks)

Answer

- Topic: Petroleum Profits Tax (PPT)

- Series: MAY 2018

- Uploader: Dotse