- 12 Marks

Question

Mr. James Ado who is a successful businessman built a house for commercial purposes at Surulere, Lagos, in 2018.

You are given the following information:

(i) The area of the land parcel is 3,600 square metres.

(ii) The average market value of a land parcel in the neighbourhood, on a per square metre basis is N17,000 as determined by the professional valuers appointed by the Commissioner.

(iii) The total developed floor area of the building on the plot of land is 2,000 square metres.

(iv) The average construction value of medium quality buildings and improvements in the neighbourhood, on a square metre basis, is put at N200, based on the market value of the property as determined by professional valuers.

(v) The depreciation rate for the buildings and improvements of land based on the age of the building is put at 1%.

(vi) The annual relief rate is 40%.

(vii) The annual charge rate expressed as a percentage of the assessed market value of the property is 0.76% of the assessed value.

Required:

Compute the land use charge payable by Mr. James Ado.

Answer

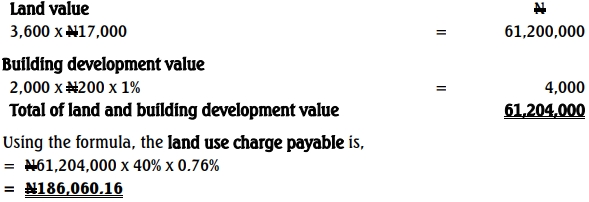

Mr. James Ado

Computation of land use charge payable

Land use charge formula is

(Land value + building developments value) x relief rate x charge rate

interpreted as

LUC = [(LA x LR) + (BA x BR x DR) x RR x CR]

Where LUC = Annual amount of land use charge

LA = Area of the land parcel in square metres

LR = The average market value of a land parcel in the neighbourhood

BA = The total developed floor area of building on the plot of land in square metres

BR = The average construction value of medium quality buildings and improvements in the neighbourhood

DR = The depreciation rate for the building and improvements of land

RR = The rate of relief from tax

CR = The annual charge rate expressed as a percentage of the assessed market value of the property.

- Tags: Commercial Property, Lagos State, Land Use Charge, Property Valuation, Tax computation

- Level: Level 1

- Topic: Tax Administration and Enforcement

- Series: MAY 2021

- Uploader: Kwame Aikins