- 10 Marks

Question

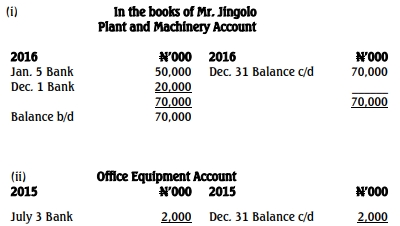

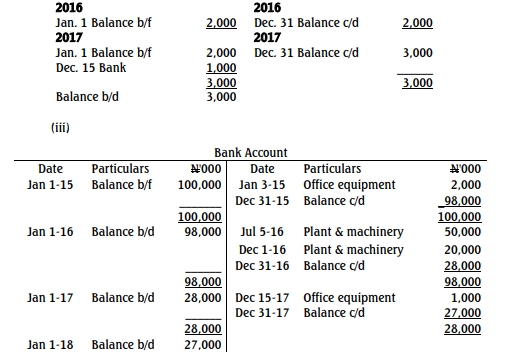

Mr. Jingolo is a trader who prepares accounts to December 31 each year. The following transactions with regard to non-current assets have taken place:

- January 3, 2015: Purchased one office equipment for N2,000,000.

- July 5, 2016: Purchased plant and machinery costing N50,000,000.

- December 1, 2016: Purchased plant and machinery for N20,000,000.

- December 15, 2017: Bought office equipment for N1,000,000.

- Bank balance as at January 1, 2015 was N100,000,000.

Mr. Jingolo maintains his non-current assets at cost and keeps a separate ledger for each type of non-current asset. All assets are purchased and are paid for immediately.

Required:

i. Prepare plant and machinery account. (1 Mark)

ii. Prepare office equipment account. (3 Marks)

iii. Prepare bank account. (6 Marks)

Answer

- Tags: Depreciation, Double Entry, Non-current Assets

- Level: Level 1

- Topic: Depreciation Methods and Accounting for Disposals

- Series: MAY 2018

- Uploader: Theophilus