- 20 Marks

Question

A company that operates below break-even point year-after-year needs to be restructured.

a. What is break-even point? (2 Marks)

b. Elebu Nig. Plc. manufactures four products at its GBOOPA Plant in Olorungbebe Industrial Estate.

The company sold 450,000 units of its product at N60 per unit. Variable costs are N45 per unit, while the fixed cost incurred evenly throughout the year amounted to N2,916,000, which comprises of manufacturing costs of N1,800,000 and selling costs of N1,116,000.

You are required to calculate:

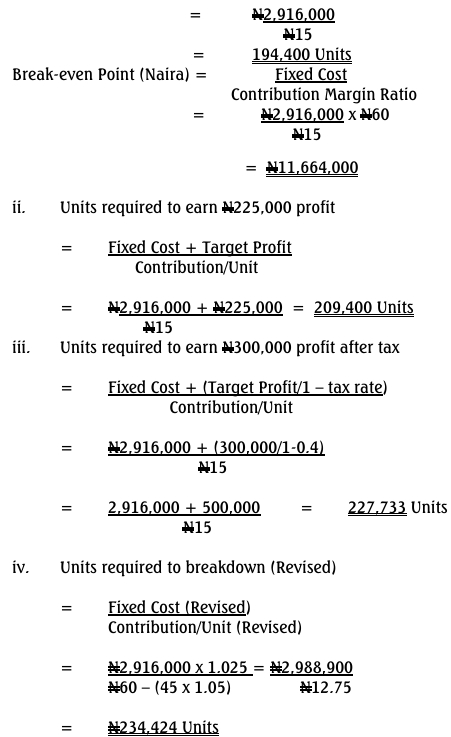

i. The break-even point in units and in value (5 Marks)

ii. The number of units that must be sold to earn an income of N225,000 before income tax (3 Marks)

iii. The number of units that must be sold to generate after-tax profit of N300,000 if the income tax rate is 40% (5 Marks)

iv. The number of units required to break-even if the fixed cost increases by 2.5% and variable cost increases by 5% (5 Marks)

Answer

a. The break-even point is the point where the total revenue equals total costs, resulting in neither profit nor loss. It is the point where a company’s sales cover its fixed and variable costs.

Break-even point (units) = ![]()

- Tags: After-tax Profit, Break-Even Point, Fixed Costs, Target Profit, Variable Costs

- Level: Level 1

- Topic: Cost-Volume-Profit (CVP) Analysis

- Series: NOV 2014

- Uploader: Dotse