- 10 Marks

Question

Propati Limited has a fleet of motor vehicles that are used to distribute goods to the market. As at July 2020, the cost of the vehicles was ₦750,000,000 and their accumulated depreciation was ₦30,500,000. On January 1, 2021, the company bought a new vehicle for ₦2,800,000. One of the old vehicles, which was acquired 3 years ago at a cost of ₦1,000,000 with accumulated depreciation of ₦600,000, was accepted by the seller in part-exchange at a value of ₦480,000.

Required:

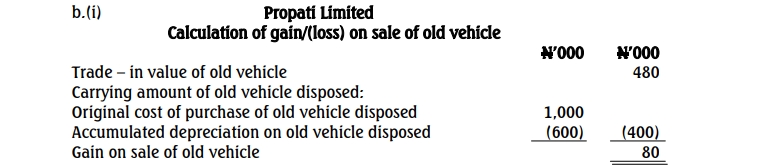

i. Calculate the gain or loss on disposal of the old car. (2 Marks)

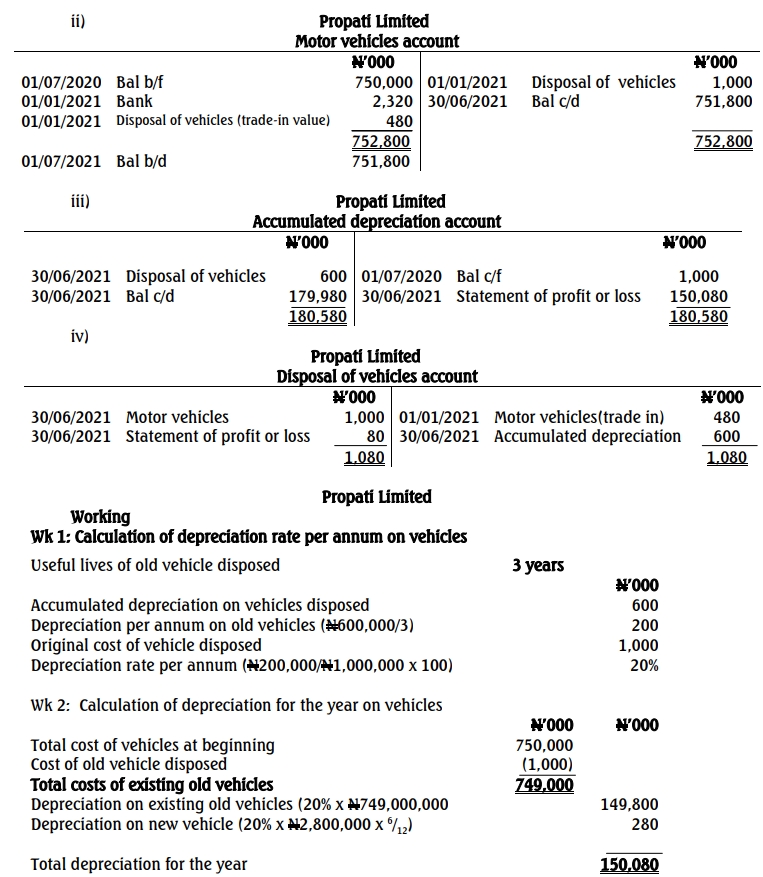

ii. Prepare the following ledger accounts in respect of the transactions:

- Motor vehicles account (4 Marks)

- Accumulated depreciation account (2 Marks)

- Disposal of asset account (2 Marks)

Answer

- Tags: Disposal of assets, Gain or Loss, IAS 16, Ledger Accounts

- Level: Level 1

- Uploader: Theophilus