Plateau Plc. (PT) is a Nigerian company that manufactures and sells innovative products. Following favourable market research that cost N4,000,000, PT has developed a new product. It plans to set up a production facility in Kano, although its board had contemplated setting up the facility in an overseas country. The project will have a life of four years.

The selling price of the new product will be N5,900 per unit, with sales in the first year to December 31, 2019, expected to be 120,000 units, increasing by 5% per annum thereafter. Relevant direct labour and material costs are expected to be N3,400 per unit, and incremental fixed production costs are expected to be N60 million per annum. The selling price and costs are stated in December 31, 2018 prices and are expected to increase at a rate of 3% per annum. Research and development costs to December 31 will amount to N25 million.

Investment in working capital will be N30 million on December 31, 2018, and this will increase in line with sales volumes and inflation. Working capital will be fully recoverable on December 31, 2022.

The company will need to rent a factory during the life of the project. Annual rent of N20 million will be payable in advance on December 31 each year and will not increase over the life of the project.

Plant and machinery will cost N1 billion on December 31, 2018. The plant and machinery are expected to have a resale value of N300 million (at December 31, 2022, prices) at the end of the project. The plant and machinery will attract 20% (reducing balance) capital allowances in the year of expenditure and in every subsequent year of ownership by the company, except in the final year when there will be a balancing allowance or charge.

Assume a corporate tax rate of 20% per annum in the foreseeable future and that tax flows arise in the same year as the cash flows which gave rise to them.

The directors are concerned by rumours in the industry of research by a rival company into a much cheaper alternative product. However, the rumours suggest that this research will take another year to complete, and if successful, it will take a further year before the alternative product comes on the market.

An appropriate weighted average cost of capital for the project is 10% per annum.

Required:

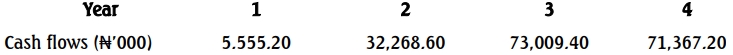

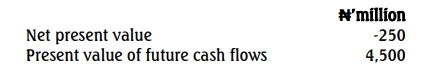

a. Calculate, using money cash flows, the NPV of the project on December 31, 2018, and advise the company whether to proceed with the project or not.

(15 Marks)

b. Calculate and interpret the sensitivity of the project to a change in:

- (i) The annual rent of the factory (2 Marks)

- (ii) The weighted average cost of capital (4 Marks)

c. If the board of PT decided to set up the manufacturing facility overseas, advise the board on how political risk could change the value of the project and how it might limit its effects. (4 Marks)

d. Discuss briefly FOUR real options available to PT in relation to the new project. (5 Marks)

(Total 30 Marks)