Navigating the world of professional accounting qualifications can feel overwhelming, but understanding ICAG Assessments right from the start makes all the difference. This article dives deep into the nuts and bolts of how the Institute of Chartered Accountants of Ghana (ICAG) evaluates aspiring chartered accountants through its exams, including the specific formats, what it takes to pass, and the rules that guide your journey from one level to the next. If you’re coming from our main guide on the Key Benefits of the New ICAG Qualification Structure, you’ll recall how the revamped framework emphasizes practical skills, technology integration, and global relevance—streamlining the path to becoming a well-rounded professional while aligning with Ghana’s economic needs and international standards. That piece highlights perks like shorter completion times, more flexible exemptions, and a focus on emerging areas like sustainability and digital tools, setting the stage for why mastering these assessments is key to unlocking those advantages.

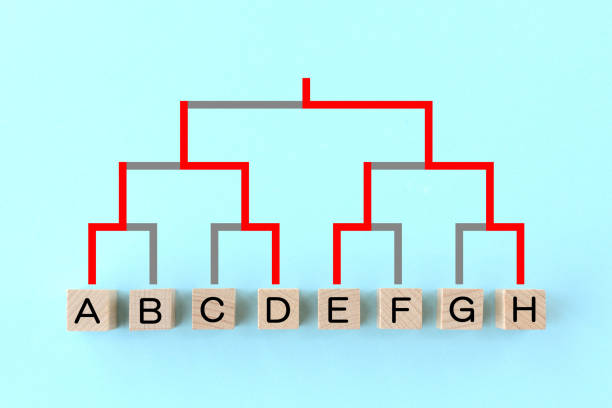

The Structure Behind ICAG Assessments: An Overview of Levels and Subjects

Let’s get straight to it: the ICAG qualification isn’t just a series of random tests; it’s a carefully tiered system designed to build your expertise step by step. Under the new syllabus rolled out for 2024-2029, everything revolves around three distinct levels—Knowledge, Application, and Professional—each ramping up the complexity to mirror real-world accounting challenges. You start at the Knowledge Level, where the focus is on foundational concepts that set the groundwork for everything else. Here, you’ll tackle four subjects: Financial Accounting, Business Management and Information Systems, Business and Corporate Law, and Introduction to Cost & Management Accounting. These aren’t overly complicated; they’re meant to ensure you grasp the basics, like preparing simple financial statements or understanding legal frameworks in business.

As you move to the Application Level, things shift gears. This is where theory meets practice, and you’re expected to apply what you’ve learned in straightforward but realistic scenarios. The six subjects include Financial Reporting, Management Accounting, Audit and Assurance, Financial Management, Public Sector Accounting and Finance, and Principles of Taxation. Imagine dealing with client-specific needs, such as computing tax liabilities under Ghanaian laws or auditing public sector finances—these assessments push you to produce technically sound outputs that could actually be used in a professional setting.

Finally, the Professional Level is the pinnacle, honing your ability to make high-stakes judgments. With four subjects—Corporate Reporting, Advanced Audit and Assurance, Advanced Taxation, and Strategic Case Study—you’ll face complex, often ambiguous scenarios that demand analysis, evaluation, and strategic advice. For instance, in the Strategic Case Study, you might evaluate a company’s sustainability strategy amid economic shifts in Ghana, drawing on pre-seen materials to craft recommendations. This structure ensures that by the end, you’re not just knowledgeable but truly competent, ready to handle the demands of chartered accountancy.

What ties it all together is the progressive nature of these levels. You can’t cherry-pick; the syllabus links outcomes across stages, so weaknesses early on will haunt you later. And with ICAG’s emphasis on competencies like critical thinking and ethical judgment—woven into every assessment—it’s clear this isn’t about rote learning. At platforms like knowsia, we see this as an opportunity: our question banks and AI-powered practice tools can help you simulate these progressions, turning potential stumbling blocks into strengths.

Exam Formats in ICAG Assessments: From MCQs to Case Studies

When it comes to the actual format of ICAG Assessments, ICAG has modernized things significantly with the new syllabus. Starting in 2025, expect a shift to Computer-Based Exams (CBE), which brings efficiency and adaptability. For the Knowledge Level, it’s straightforward: multiple-choice questions (MCQs) dominate, testing your recall and basic understanding through objective testing. You’ll get structured data—think simple calculations or identifications—and need to select the right answers quickly. This format keeps things accessible for beginners, but don’t underestimate it; the questions are crafted to probe your grasp of core principles, like distinguishing between accrual and cash accounting.

Things evolve at the Application Level. Here, exams blend computer-assisted testing with written responses, focusing on scenarios that mimic workplace tasks. You might compile financial reports using given data or explain assurance processes in an audit context. The format often includes short-answer questions, computations, and mini-case studies, where you’re applying knowledge to client-oriented problems. For example, in Principles of Taxation, you could calculate liabilities incorporating recent Ghanaian tax reforms, like those influenced by the African Continental Free Trade Area (AfCFTA).

By the Professional Level, the formats demand more sophistication. Exams here are typically three-hour papers with a mix of unseen questions and pre-seen case materials, especially in the Strategic Case Study. You’ll analyze challenging situations—perhaps evaluating corporate governance in a multinational firm operating in Ghana—and provide critical commentary or recommendations. Formats include essay-style responses, evaluations, and advisory notes, emphasizing articulation and judgment. Across all levels, verbs from Bloom’s taxonomy guide the tasks: “identify” and “explain” at lower levels, escalating to “evaluate” and “advise” higher up.

This variety in formats isn’t arbitrary; it’s designed to assess a range of skills, from technical proficiency to strategic thinking. And with CBEs phasing in gradually—starting with Level 1 MCQs and expanding to others—ICAG is making assessments more tech-savvy, aligning with global trends. If you’re prepping, tools on Knowsia, like our past questions and expert-led simulations, can help you practice these formats without the guesswork.

Pass Marks for ICAG Assessments: What You Need to Aim For

Passing ICAG Assessments boils down to a clear benchmark: 50% out of 100 marks per paper. It sounds simple, but achieving it requires consistent performance across all sections. Every exam is marked out of 100, with no partial credits for effort— you either hit the threshold or you don’t. This pass mark applies uniformly across levels, whether you’re answering MCQs at Knowledge or dissecting a strategic case at Professional. Markers allocate points based on syllabus weightings; for instance, in Corporate Reporting, 30% might go toward applying IFRS standards, so nailing those earns you a big chunk.

But here’s the kicker: while 50% is the floor, the assessments reward depth over breadth. In Application and Professional levels, partial marks are common for well-reasoned attempts, even if the final answer isn’t perfect. Say you’re computing advanced tax implications; showing logical steps can salvage points. Ethics integration adds another layer—demonstrating professional skepticism might tip a borderline paper over the line.

Failing to reach 50% means a referral, but ICAG allows resits without limits, as long as you follow progression rules. The key is balance; since marks approximate topic weightings, skimping on high-weighted areas like IPSAS in Public Sector Accounting could sink you. Students often overlook this, focusing on favorites, but the pass mark demands holistic preparation. Transitioning smoothly, this ties directly into how progression works, where passing isn’t just about one exam but the whole level.

Progression Rules in ICAG Assessments: Step-by-Step Advancement

Progression in ICAG Assessments is strict but logical—you must conquer one level before tackling the next. No skipping ahead; complete all Knowledge Level papers (or get exemptions) to enter Application, and finish Application to access Professional. This rule ensures foundational skills are solid, preventing gaps that could derail advanced studies. For example, without mastering Financial Accounting basics, you’d struggle with Corporate Reporting’s consolidations.

There’s flexibility in how you pass within a level: no mandatory subject combinations, just clear all papers. Exams happen twice yearly (May and November), giving you chances to resit without derailing your timeline. However, the syllabus’s interconnectedness means referrals can delay you; if you fail one Application paper, you can’t start Professional until it’s passed.

Practical experience plays a role too—three years required for full membership, often concurrent with studies. ICAG monitors this through logs, ensuring progression isn’t just academic. And with the new syllabus, progression emphasizes competency milestones, like shifting from simple explanations to strategic evaluations. If life’s curveballs hit, deferrals are possible, but sticking to the rules keeps momentum. Many find that platforms like Knowsia, with their anytime-access resources, help maintain steady progress amid busy schedules.

Exemptions and Their Role in ICAG Assessments Progression

Exemptions can accelerate your path through ICAG Assessments, but they’re not handouts—they’re earned based on prior qualifications. Under the new rules, no exemptions for Professional Level papers; that’s where the real professional edge is forged. But for earlier levels, options abound. Hold a Diploma in Accounting? You’re exempt from all Knowledge Level papers. HND in Accountancy? Add Audit and Assurance from Application to that list.

University students get a boost too: Level 300 accounting majors from GTEC-accredited institutions with ICAG MOUs can skip Knowledge entirely, plus select Application subjects like Taxation, if endorsed by deans or ambassadors. Bachelor’s holders in accounting bypass Knowledge and two Application papers, while master’s grads with accounting backgrounds might waive most of Application except Public Sector Accounting.

Other pros, like ATSWA holders, get subject-by-subject relief up to Application. ICAG reviews these rigorously, requiring transcripts and alignments with syllabus outcomes. This speeds progression for experienced folks, potentially shaving years off, but you still prove yourself in assessments. It’s a smart way to personalize your journey, and at knowsia our affiliate programs let you share exemption strategies while earning from your insights.

Preparing Effectively for ICAG Assessments: Tips and Strategies

Preparation for ICAG Assessments demands more than cramming; it’s about strategic engagement. Start by mapping the syllabus—understand weightings to prioritize, like focusing 20% effort on strategic analysis in Case Study. Practice formats relentlessly: MCQs for speed at Knowledge, scenarios for Application’s realism.

Time management is crucial; allocate study hours mirroring exam durations. Use past papers to spot patterns—ICAG often tests ethics in audits or tax reforms in Ghana’s context. Group studies can clarify doubts, but solo reviews build confidence. And don’t ignore well-being; burnout leads to silly errors below that 50% mark.

Incorporate tech: CBEs mean practicing on screens, simulating the phased rollout. Resources like Knowsia’s AI tools analyze your weak spots, offering tailored drills. Remember, progression rules mean consistent wins, so aim for first-time passes. Burst through plateaus with varied methods—videos for laws, calculations for finance—and track progress weekly.

Challenges and Common Pitfalls in ICAG Assessments

Every candidate hits roadblocks in ICAG Assessments, but knowing them helps dodge pitfalls. Underestimating formats is common; Knowledge MCQs seem easy, but they trap with tricky distractors. At Professional, ambiguity in cases can overwhelm if you’re not used to evaluating unseen issues.

Pass marks trip up overconfident folks—50% sounds low, but partial credits require precise reasoning. Progression stalls from unbalanced prep; failing one paper halts everything. Exemptions sound great, but mismatched prior learning leaves gaps.

Time pressures in exams lead to rushed answers, costing marks. Ethical dilemmas, integrated everywhere, catch those ignoring soft skills. Ghana-specific elements, like public sector finance, surprise internationals. Overcome by diversifying study—mix theory with practice—and seeking mentors. Knowsia fosters this through teaching opportunities, where explaining concepts reinforces your own understanding.

The Future of ICAG Assessments: Trends and Updates

Looking ahead, ICAG Assessments are evolving with global shifts. The 2024-2029 syllabus already embeds sustainability, AI, and digital taxation, reflecting Ghana’s growth. CBEs will expand, making exams more accessible remotely.

Progression might incorporate more continuous assessment, blending exams with portfolios. Pass marks could stay steady, but emphasis on competencies like data analytics will rise. Exemptions may broaden for tech certifications, aligning with ICAG’s innovation push.

For aspirants, staying updated via ICAG’s site or communities is key. This forward-thinking approach ensures chartered accountants remain relevant, tackling challenges like climate reporting or e-commerce taxes. At knowsia we’re all about empowering this—learn, teach, earn—turning assessments into launchpads for careers.

Conclusion: Mastering ICAG Assessments for Long-Term Success

Wrapping up, ICAG Assessments—with their formats, 50% pass marks, and strict progression rules—form the backbone of a qualification that’s both rigorous and rewarding. From MCQ foundations to strategic cases, they build pros equipped for Ghana’s dynamic economy. Leverage exemptions wisely, prepare holistically, and avoid common traps to progress smoothly.

Remember, it’s not just passing; it’s growing. As the new structure benefits unfold—like those detailed in our linked guide—these assessments become your gateway. Whether you’re studying solo or on platforms like knowsia, where you can access past questions, teach others, and even earn through contributions, the tools are there. Dive in, stay persistent, and you’ll emerge not just qualified, but empowered.

I have a degree in Social Sciences (Economics and Sociology) from the University of Cape Coast. I work as Budget Analyst with six years experience. Am I likely to an exemption for any of the level one courses?

Yes Daniel

They review your transcript on subject-by-subject basis.